Oracle Corporation (NYSE: ORCL) just printed a bearish engulfing pattern—one of the most respected reversal signals in candlestick lore. This pattern shows up when a larger red (bearish) candle completely wraps around the previous day’s green (bullish) candle, closing lower and signaling that sellers have seized control.

Steve Nison, the pioneer who brought Japanese candlestick analysis westward, puts it simply: “The engulfing pattern is a powerful clue that momentum has shifted.” The textbook version features a strong green candle followed by an even stronger red one that opens higher and closes lower than the previous session. The greater the engulfment, the louder the message.

In classic form, this engulfing candle towers over its predecessor like a storm front overtaking the horizon—visually and psychologically dominant.

Bearish Engulfing Candle

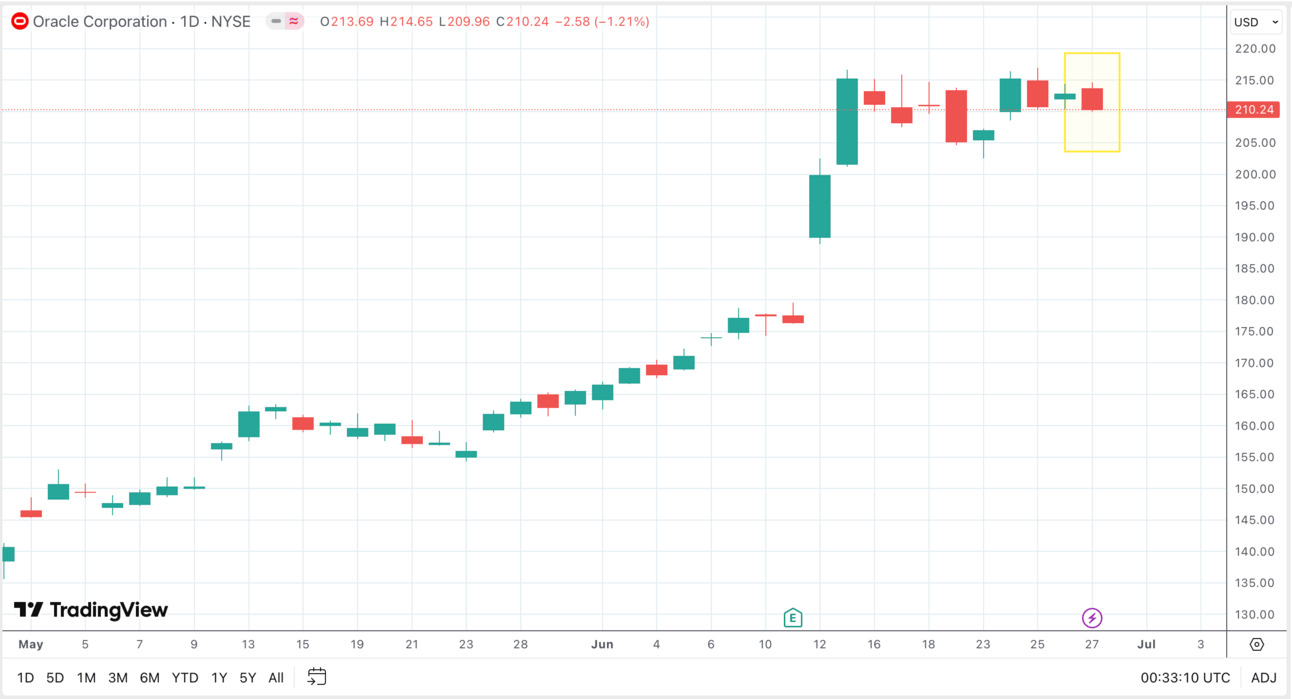

And now, zoom in on the real-world chart of ORCL above (pattern boxed in yellow). After a vertical earnings-driven rally and brief consolidation, Oracle just posted a bearish engulfing pattern right near its highs. The timing? Not random. The psychology? Potent.

Oracle - Bearish Engulfing Pattern

Oracle (ORCL) is a global software giant, best known for its database technologies and, more recently, its bold AI and cloud computing push. Shares ripped higher in early June after strong earnings, but the bullish momentum is now showing its first real crack.

Reading the Pattern in Context:

Zoom into the final two candles in the yellow box. The first, a modest green, reflected an intraday attempt at continuation. But the next day, a wide-range red candle opens higher and closes below the prior day’s low. That’s a full engulfment, and it came after multiple attempts to hold the $215–217 area.

The setup screams hesitation turning into retreat. Sellers stepped in with volume, rejecting highs and suggesting the rally may be exhausting. As Nison says, “When the market fails to follow through after strong bullish candles, pay attention. The psychology is shifting.”

Trading a Bearish Engulfing:

Candlestick traders often use this pattern as a potential short signal — particularly when it forms at or near resistance levels or after extended uptrends. The classic play? Enter on confirmation (e.g., a lower close the next day), with a stop just above the pattern’s high and a target based on the recent support or retracement zones.

As always: Patterns don’t predict, they prepare. The key is in the context, not just the candles.

What to Watch Next:

If ORCL dips below $209 with follow-through volume, it could trigger a retest of the $200–202 area. Keep an eye on how the next few candles behave—stalling versus plunging will tell us how serious the sellers are.

Key Takeaways:

ORCL just printed a clean bearish engulfing near its post-earnings highs

Pattern signals a possible momentum shift after a strong rally

Traders watch for confirmation and follow-through, not just the pattern

Context and psychology matter: this came after a major vertical move