The shooting star is a single-candle reversal pattern that earned its name from its distinctive appearance: a small real body positioned at the lower end of the session's range, with a long upper shadow extending upward like a shooting star blazing across the sky. As Steve Nison notes, "the Japanese aptly say that the shooting star shows trouble overhead."

The shooting star tells the story of intraday rejection. After a strong uptrend has been in effect, the atmosphere is bullish. The price opens and trades higher—the bulls are in control. But before the end of the day, the bears step in and take the price back down to the lower end of the trading range. As Stephen Bigalow explains:

"After a strong uptrend has been in effect, the atmosphere is bullish. The price opens and trades higher. The bulls are in control. But before the end of the day, the bears step in and take the price back down to the lower end of the trading range, creating a small body for the day."

This shift from bullish momentum to intraday selling pressure is what makes the pattern meaningful. When assessing shooting star quality, look for an upper shadow at least twice the length of the real body. The ideal formation includes a gap up from the previous session's close, though this isn't required. A small or absent lower shadow strengthens the signal—showing that sellers successfully defended the highs without buyers managing any meaningful recovery.

Shooting Star

Chart Analysis: PR's Shooting Star Formation

The Setup

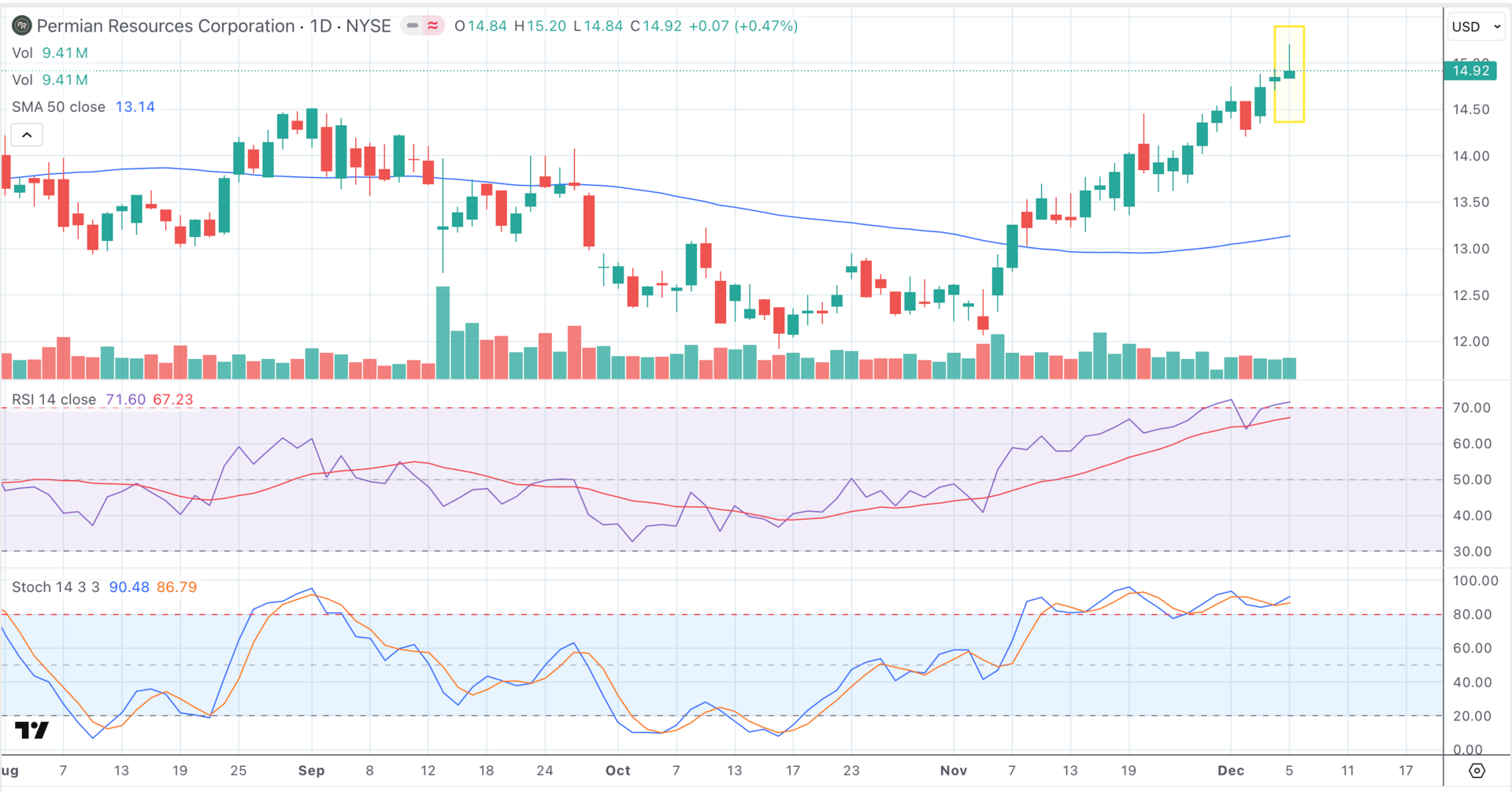

Permian Resources Corporation rallied cleanly from mid-November, climbing from the low-$13 range to test the psychologically significant $15 level by early December. The advance was methodical, building higher lows along the way as the 50-day moving average (visible at $13.14) provided underlying support. Volume remained relatively steady through the rally, averaging 8-10 million shares per session, while the RSI climbed from oversold territory into the 64-71 range—indicating strong but not yet extreme momentum.

The Pattern Formation

Friday's session opened at $14.84 and immediately rallied, pushing to an intraday high of $15.20—a fresh multi-week peak. But sellers emerged at this round-number resistance level, driving prices back down to close at $14.92. Looking at the chart, we can see the distinctive shooting star formation: a small green body of just $0.08 ($14.92 close vs $14.84 open) positioned at the lower end of the range, with a long upper shadow extending $0.28 to the $15.20 high. The upper shadow measures 3.5 times the height of the real body—well above the 2:1 minimum threshold that defines a quality shooting star. Notice how the pattern formed precisely as PR tested the $15 psychological barrier, with the RSI reaching 71.60—not quite overbought, but elevated enough to suggest momentum was becoming stretched.

The Technical Context

This shooting star gains significance from multiple converging factors. First, the $15 level represents a clean psychological resistance zone—round numbers often act as natural profit-taking points where sellers congregate. Second, the pattern appeared after a five-week advance of roughly 13% from the mid-November lows, suggesting the easy gains may already be priced in. Third, the RSI at 71.60 shows momentum stretched into the upper range without quite reaching overbought extremes—a zone where rallies often pause or consolidate. The Friday volume of 9.41 million shares was slightly above recent averages, adding weight to the intraday rejection. Here's where pattern quality matters: when a textbook shooting star with a 3.5:1 shadow-to-body ratio forms at psychological resistance with elevated RSI, the pattern carries maximum significance as a warning signal.

Trading the Shooting Star Pattern

Educational Note: The following describes common approaches used by candlestick practitioners and is not trading advice. All trading involves significant risk.

Entry Strategy & Confirmation

When setting entries for shooting star patterns, candlestick traders often watch for confirmation in the following session. The pattern itself is a warning, not a trigger. Practitioners typically wait for Monday's price action to validate the reversal thesis—specifically, a close below Friday's low at $14.84 would confirm that sellers have seized control. A gap down opening or a black candle that closes below the shooting star's real body provides even stronger confirmation.

"The following day needs to confirm the Shooting Star signal with a black [red] candle or better yet, a gap down with a lower close. A lower open or a black [red] candle the next day reinforces the fact that selling is going on."

Risk Management & Exit Strategy

When defining risk for bearish patterns, candlestick traders will often identify where the thesis breaks down. For this PR shooting star, that would typically be above the high at $15.20—the level that bulls failed to hold on Friday. The logic is straightforward: if buyers can reclaim and close above $15.20, it negates the rejection pattern and suggests the uptrend remains intact.

Candlestick analysts will look for targets by scanning for support zones below: the recent consolidation near $14.50-$14.60, the early-week support at $14.21-$14.29, and ultimately the 50-day moving average at $13.14. This creates a tiered target structure: first target near $14.50 (risk of $0.28 for potential gain of $0.42, or 1.5:1 reward-to-risk), second target at $14.20 (2.6:1), and final target at $13.14 (7.4:1).

What to Watch Next

Monday's session determines whether the shooting star confirms or fails—a close below $14.84 would validate the bearish thesis, while strength back above $15 with conviction would negate the reversal signal and suggest the rally still has fuel.

Key Takeaways

Pattern Formation at Critical Resistance: The shooting star formed precisely at the $15 psychological barrier after a clean five-week rally from $13, with the RSI reaching 71.60 to signal stretched but not extreme momentum.

High-Quality Technical Setup: The upper shadow measures 3.5 times the real body's height—well above expert criteria—and the $0.36 intraday range from $14.84 low to $15.20 high demonstrates aggressive intraday rejection at resistance.

Confirmation Protects From False Signals: Pattern confirmation requires Monday's close below $14.84, marking a lower low and validating that Friday's intraday selling pressure has translated into sustained bearish follow-through.