"Not only does the knowledge of what a signal looks like benefit the candlestick educated investor, but learning the common-sense psychology that formed the signal provides the investor with a whole new perspective into successful investing."

— Stephen W. Bigalow

Japanese candlestick patterns aren't just bars on a chart. They're emotional fingerprints or visual records of participant fear, greed, indecision, and conviction playing out in real time and visible on a chart.

Successful candlestick traders don’t just spot the pattern, they understand why the pattern formed. When traders grasp the psychology behind these signals, they aren’t just memorizing candle patterns — they are tuned in to the collective mind of the market.

Here are five candlestick patterns and the psychology behind each.

The Doji: Paralysis at the Crossroads

What It Looks Like: A candle where the open and close are virtually identical, creating a cross or plus sign. The body disappears. Only shadows remain.

Doji Bullish Reversal

Doji Bearish Reversal

The Psychology: The doji captures a moment of perfect indecision — a tug-of-war between buyers and sellers that ends in a draw. After the market opens, bulls and bears battle throughout the session, pushing prices up and down. But by the close, neither side has won. The price ends exactly (or nearly) where it started.

This indecision becomes explosive when it appears after a strong trend. Why? Because trends are built on conviction. When conviction evaporates and indecision takes over, the existing trend is running out of fuel.

As Bigalow explains: "The fact that the Doji has powerful implications and it is so easily identified, makes it one of your best signals for producing profits." (Profitable Candlestick Trading)

The Common-Sense Truth: When you see a doji after prices have been climbing for days or weeks, it's telling you that the buyers who were aggressively pushing prices higher are now hesitant. The sellers haven't taken over yet — but the buying pressure has stalled. It's the market catching its breath before deciding which way to move next.

At market tops, a doji often signals that "the bulls and bears were not letting the price move in either direction" (Bigalow). In an uptrend, this is your warning: the easy money has been made. What comes next is uncertain.

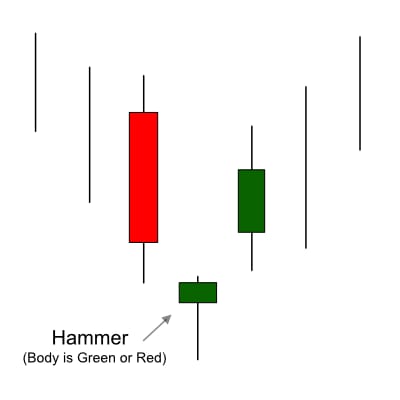

2. The Hammer: When Bears Lose Their Grip

What It Looks Like: A small real body at the top of the trading range with a long lower shadow—at least twice the length of the body. Little to no upper shadow. It looks like a hammer or a lollipop.

Hammer

The Psychology: The hammer tells a story of attempted defeat turning into defiance. After a downtrend, the market opens and the bears immediately push prices lower, extending the decline. Fear is in control. Selling accelerates.

But then something shifts. At some price level, buyers step in. They don't just nibble—they push back hard, driving prices back up to close near the highs of the day. By the time the session ends, the bears' entire effort has been erased.

As Bigalow describes it: "The Hammer only requires common sense to understand. After a downtrend, the bears open the price and continue to push the prices lower. Finally, it reaches a level where the bulls decide to start stepping in. Before the end of the day, the bulls have brought the price back up toward the top of the trading range."

The Common-Sense Truth: If the bears can't hold prices down even when they have all day to do it, what makes anyone think they'll be stronger tomorrow? The hammer shows you exactly where bargain hunters are waiting. When the market gets cheap enough, buyers overwhelm sellers — and that information is painted right there in the long lower shadow.

3. The Shooting Star: Trouble Overhead

What It Looks Like: The mirror image of the hammer—a small real body at the bottom of the range with a long upper shadow. The market tried to rally but failed spectacularly.

Shooting Star

The Psychology: A shooting star captures the moment when optimism gets rejected. After an uptrend, the market opens and bulls immediately push prices higher, often continuing the rally into new territory. Confidence is high. The trend looks unstoppable.

But then reality hits. Sellers step in aggressively, pushing prices back down. By the close, the entire rally has been erased. What looked like strength was actually weakness in disguise.

Steve Nison describes it vividly: "The shooting star pictorially tells us that the market opened near its low, then strongly rallied and finally backed off to close near the opening. In other words, that session's rally could not be sustained." (Japanese Candlestick Charting Techniques)

The Japanese say the shooting star "shows trouble overhead". That long upper shadow is a red flag waving at you.

The Common-Sense Truth: When bulls try to push prices higher and fail — not just by a little, but by retracing the entire day's gains — it reveals that sellers are waiting at these levels. As Bigalow notes: "When the bulls try to advance the price, the bears move in and knock it back down. This should forewarn the investor that the price is getting weak at these levels."

The shooting star doesn't just show that the market went up and came back down. It shows you exactly where the resistance is—and that buyers couldn't hold their ground when they got there.

4. The Engulfing Pattern: Sentiment Overwhelms Itself

What It Looks Like: Two candles where the second candle's real body completely engulfs the first. In a bullish engulfing pattern (at a bottom), a large white/green candle swallows a small black/red candle. In a bearish engulfing pattern (at a top), a large black/red candle engulfs a small white/green one.

Bullish Engulfing Pattern

Bearish Engulfing Pattern

The Psychology: The engulfing pattern captures a dramatic shift in power. The first day represents the exhausted end of the prior trend—weak selling (or buying) without much conviction. The second day erupts with force in the opposite direction, overwhelming everything that came before.

From Nison's definition: "A bullish engulfing pattern is comprised of a large white (green) real body that engulfs a small black (red) real body in a downtrend. A bearish engulfing pattern occurs when selling pressure overwhelms buying force as reflected by a long black (red) real body engulfing a small white (red) real body in an uptrend." (Japanese Candlestick Charting Techniques, 2nd Edition, Glossary)

The Common-Sense Truth: Think about what's happening: the market spent an entire day moving in one direction (creating the first small candle), and then in the very next session, the opposite side came in with such force that they not only reversed that move—they exceeded it.

The engulfing pattern reveals a capitulation moment. At bottoms, it's sellers who have given up. At tops, it's buyers who are done. Bigalow emphasizes this emotional shift: "The signals are created by the change in investor sentiment. This point is the crux of the success of Candlestick analysis."

When you see an engulfing pattern, you're witnessing the moment when the losing side throws in the towel and the winning side takes complete control.

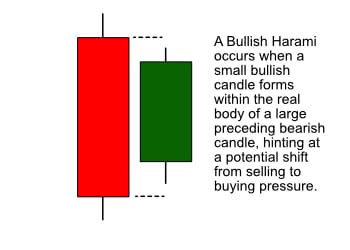

5. The Harami: A Crack in the Trend

What It Looks Like: The opposite of the engulfing pattern — a small candle contained entirely within the previous session's large real body. The name "harami" means "pregnant" in Japanese, as the small candle looks like it's inside the belly of the large one.

Bullish Harami

Bearish Harami

The Psychology: After a strong trend with large candlesticks showing conviction, the harami emerges: a tiny candle that barely moves. It's a pause. A moment of uncertainty. The market opened and closed without much movement, all within the range of the previous session.

This pause is significant because it follows conviction. When a market that was moving strongly suddenly stops moving, it signals that the momentum is exhausted. As Nison describes it in Beyond Candlesticks: "With the harami, as the Japanese would say, 'a crack has entered the market.'"

The Common-Sense Truth: The harami is a warning, not a reversal. It tells you the trend is losing steam. Think of it like this: a stock has been climbing with strong white candles for days. Suddenly, you get a day where prices barely move. No new buyers are stepping up. No sellers are panicking. Everyone is waiting.

Bigalow elaborates on the practical application: "The Harami can be used as a fairly efficient barometer. The size and the level that it closes in the previous day's body give an accurate projection of how fast or slow the reversal will occur."

Where that small candle sits within the larger body matters:

Near the top of the previous body in an uptrend? The bulls are still somewhat in control. Expect a short pause.

In the middle? Indecision. Could go either way.

Near the bottom of the previous body in an uptrend? The bears are starting to push back. This is more serious.

Japanese literature describes harami as "transition periods in the market". It's not telling you the train has reversed — it's telling you the train has slowed to a crawl. What happens next will tell you whether it starts moving again or comes to a stop.

The Common Thread: Human Nature Never Changes

What makes these five patterns so powerful isn't that they're mathematical or complex. It's that they're intuitive. Each one tells a story about what traders are doing and feeling in real time.

Nison captures this beautifully:

Technical analysis is the only way to measure the emotional component of the market. We know that many times an ounce of emotion can be worth a pound of facts.

The doji shows indecision. The hammer shows bulls fighting back. The shooting star shows bulls getting rejected. The engulfing pattern shows one side overwhelming the other. The harami shows exhaustion creeping in.

Why This Matters for Traders

When you understand the psychology behind candlestick patterns, you stop seeing random price movements and start seeing human behavior. You recognize that:

A doji after a rally means confidence is wavering

A hammer after a decline means fear has reached its limit

A shooting star after an advance means greed got slapped down

An engulfing pattern means one side has capitulated

A harami means momentum is exhausted

And here's the beautiful part: these patterns work because human nature doesn't change. Fear, greed, hope, and panic looked the same in 18th-century rice markets as they do in today's stock market. The technology changes. The speed changes. But the emotions? Those are eternal.